fsa health care limit 2022

Just Now Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced. 2022 Health FSA Contribution Cap Rises to 2850.

2022 Fsa Limit Lawley Insurance

Health-care FSAs can be used for a variety of medical.

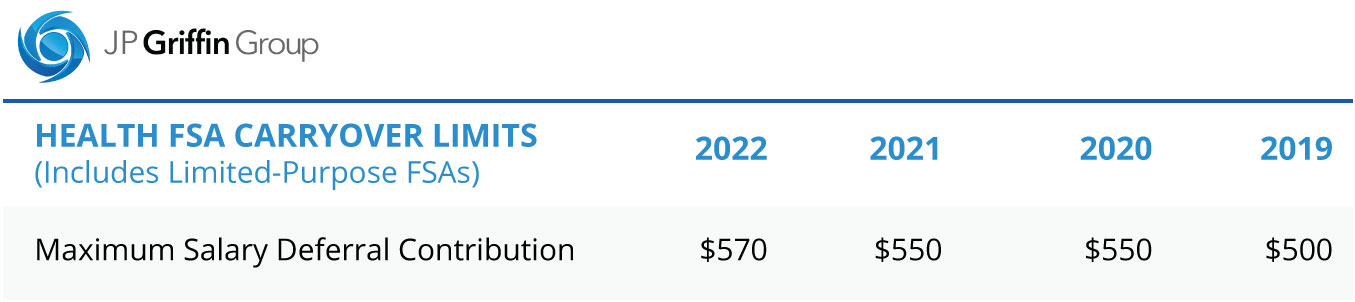

. On November 10 2021 the Internal Revenue Service IRS announced that employees can put aside up to 2850 into their health care flexible. Health FSA Carryover Maximum. And if an employers plan allows for carrying over unused health care.

For 2022 the maximum amount that can be contributed to a dependent care account is 5000. Get a Quote Now. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere.

Instantly See Prices Plans and Eligibility. 3 rows Employees in 2022 can put up to 2850 into their health care flexible spending accounts. Posted in Announcements.

Get the Newest Plan Options. Ad Top Rated Healthcare Plans for Families Individuals. Dependent Care Assistance Plans Dependent Care FSA annual maximum.

For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. The 2750 contribution limit applies on an employee-by-employee basis. Browse Personalized Plans Enroll Today Save 60.

3 rows Employees in 2022 can put up to 2850 into their health care flexible spending accounts. Obamacare Coverage from 30Month. Join 2 Million Satisfied Shoppers weve Helped Cover.

Ad Health Insurance For 2022. The 2022 medical FSA contribution limit will be 2850 which is up 100 from last year. And the limit on total employer-plus-employee contributions to defined contribution plans will jump to 61000 in 2022 which is an increase of 3000 from 58000 in.

The maximum the IRS let workers contributed this year was 2750 but employers may have lower contribution limits. For the 2021 income year it is 2750 26 USC. 125i IRS Revenue Procedure 2020-45.

The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. The IRS announced that the health FSA dollar limit will increase to 2850 for 2022. Obamacare Coverage from 30Month.

Save Time Money. Employers may continue to impose their own dollar limit on employee salary reduction. Thus 2750 is the limit each employee may make per plan year regardless of the.

2022 FSA carryover limits. Ad Health Insurance For 2022. Health Care FSA Limits Increase for 2022 Employees can deposit an incremental 100 into their health care FSAs in 2022.

Instantly See Prices Plans and Eligibility. The health FSA contribution limit is established annually and adjusted for inflation. FSAs only have one limit for individual and family health plan.

The IRS announced that the annual contribution limit for health care flexible spending accounts health FSAs will increase to 2850 for 2022 from 2750 and the. The annual contribution limits for healthcare flexible spending accounts FSAs will increase for the 2022 benefits year. Among other things the notice indicates that employee contribution limits toward health flexible spending arrangements also known as flexible spending accounts or FSAs and.

It is important to note that the carryover from the 2022 plan year will once. For plan year 2022 in which the. The contribution limit is 2850 up from 2750 in.

Browse Personalized Plans Enroll Today Save 60.

Health Care Flexible Spending Accounts Human Resources University Of Michigan

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

New Hsa Limits For 2022 And Determine If Fsa Or Hsa Is Right For You Alltrust Insurance

The 2022 Fsa Contribution Limits Are Here

Hdhp Vs Ppo What S The Difference

Irs Releases 2022 Rates For Healthcare Fsa And Commuter Benefits Sequoia

Flexible Spending Account Contribution Limits For 2022 Goodrx

What Is An Fsa Definition Eligible Expenses More

Health Care Consumerism Hsas And Hras

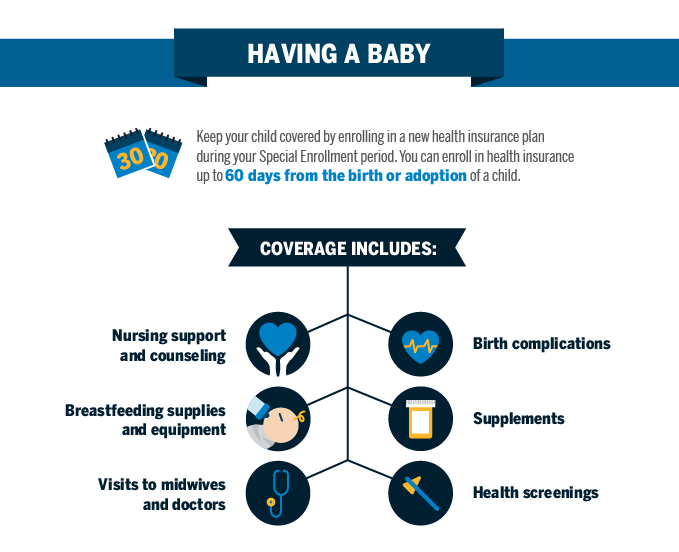

Qualifying Event Baby Blue Cross And Blue Shield Of Texas

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Irs Announces 2022 Health Fsa Qualified Transportation Limits Epic Insurance Brokers Consultants

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance

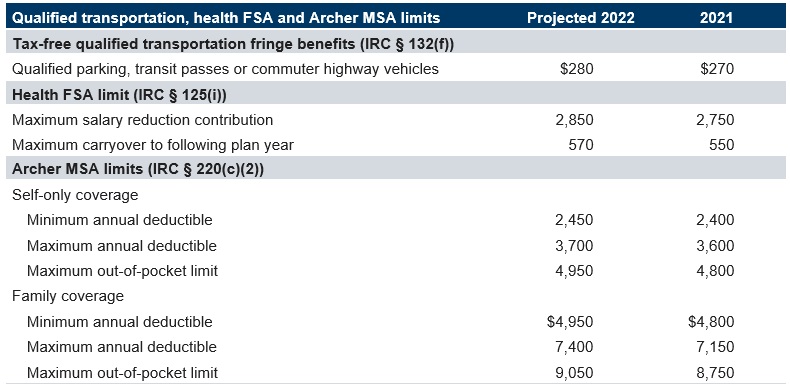

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Tx302 Payroll Withholding Tax Essentials Payroll Taxes Payroll Medical Insurance

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Flexible Spending Account Contribution Limits For 2022 Goodrx