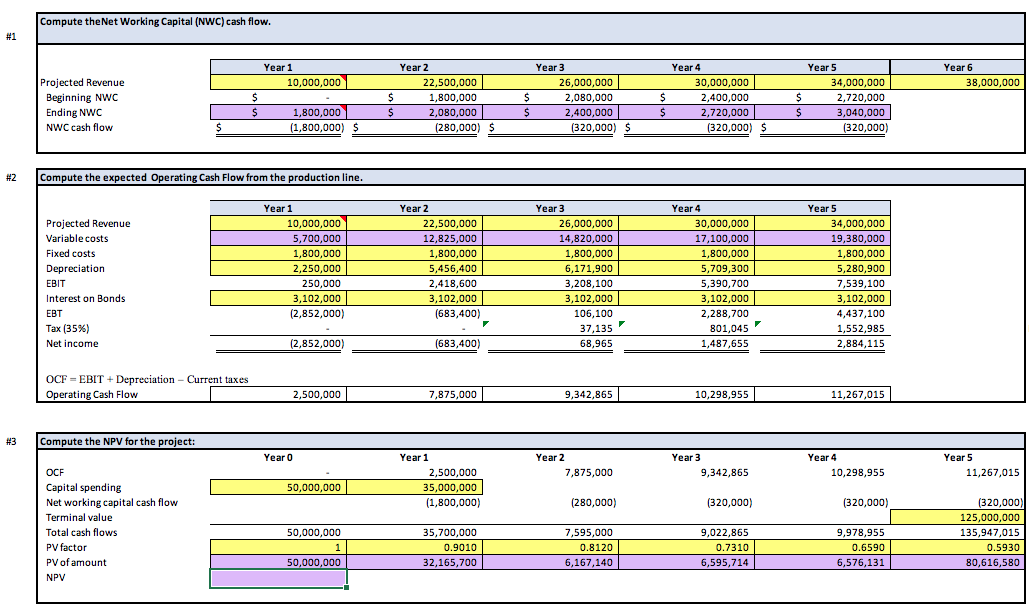

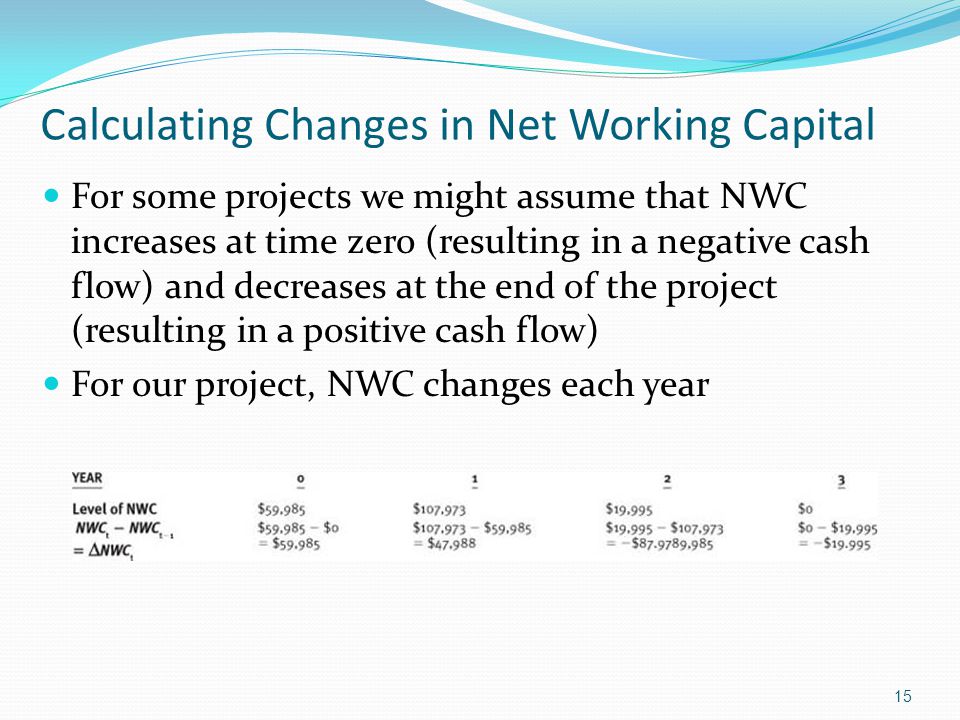

change in net working capital cash flow

Cash flow from operating activities. You just need to minus the current years working capital from last years.

A Small Business Guide To Calculating Net Working Capital

On the cash flow statement the changes in NWC.

. Whereas cash flow describes the money moving in and out of your company within a given timeframe working capital instead compares your businesss assets and liabilities. Changes in net working capital NWC should be included in an investment projects cash flows because ___. Firms need positive NPV projects for.

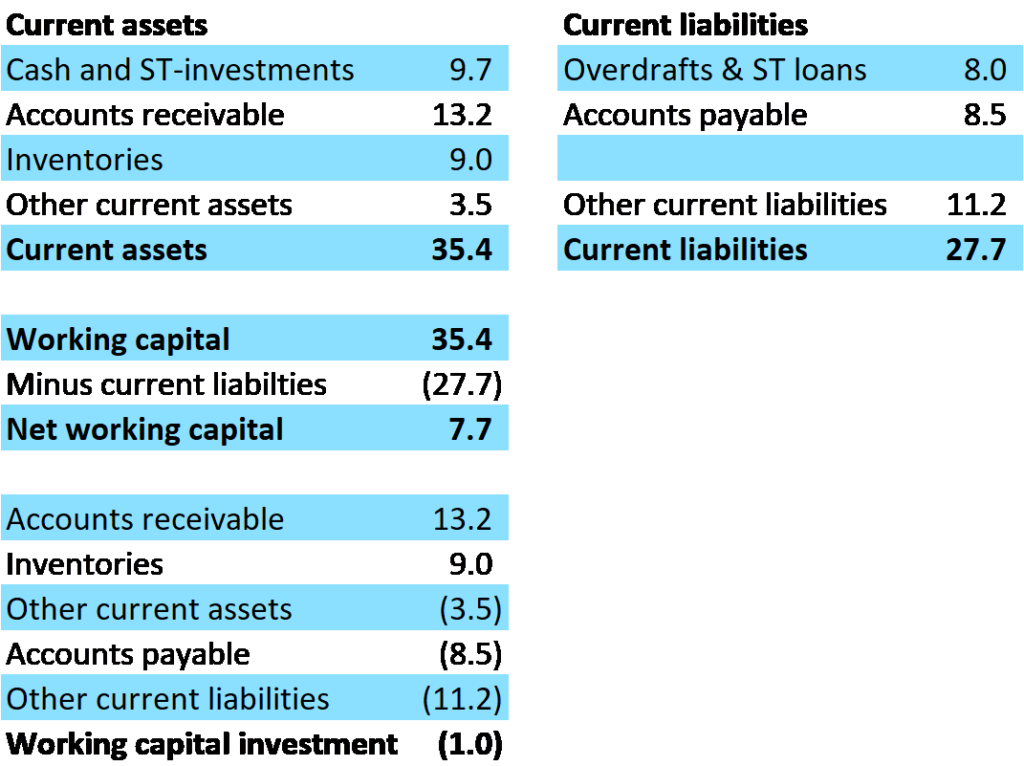

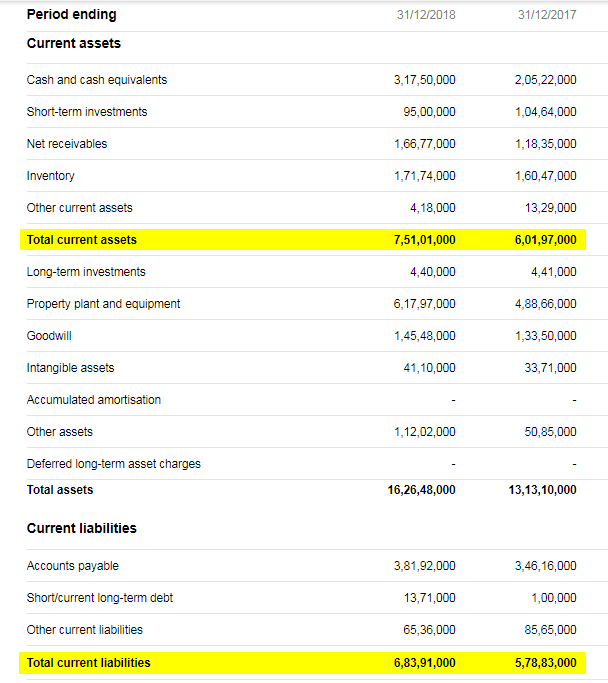

Once you have these figures you can plug them into the change in net working capital formula. For most companies you analyze by using the change in working capital in this way. Changes 2017 AR - 2016 AR 2017 Inventory - 2016 Inventory - 2017 AP - 2016 AP Step 4 Capital Expenditures.

The last step is to find the change in net working capital. Working capital increases. The reason why we subtract out the change in working capital is the fact that we would either come up with a decrease in cash flows if the change is positive or an increase in.

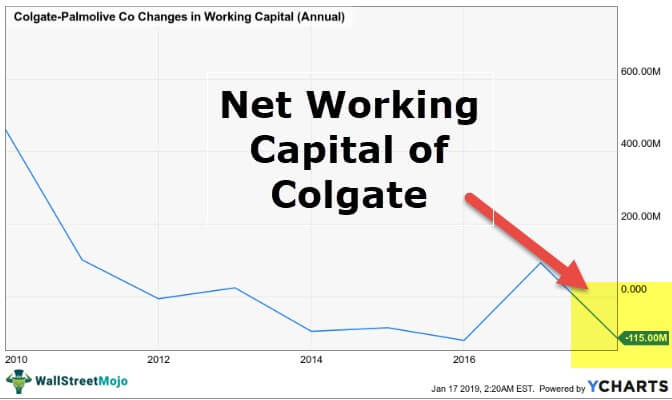

Changes in working capital -2223. Under ordinary operating conditions many if not most companies have positive working capital current assets exceed. So if your current assets are.

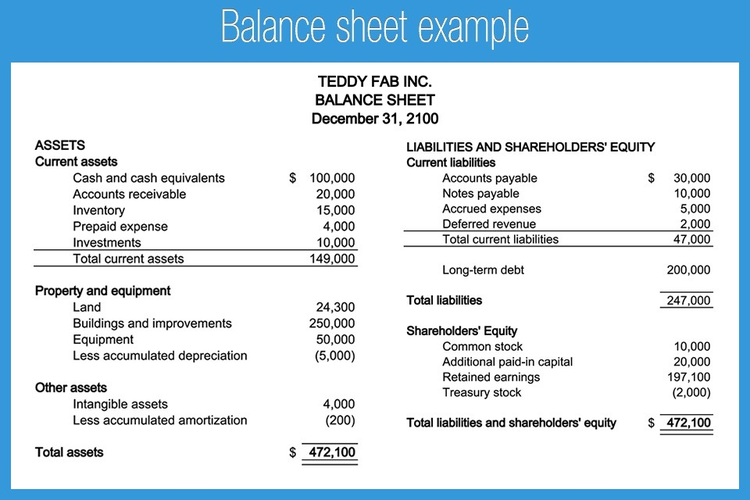

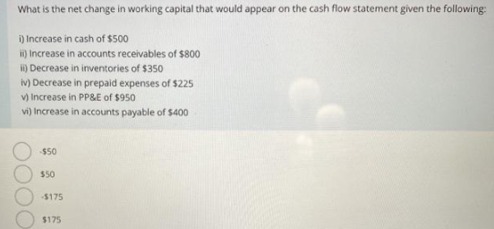

Working capital change Current assets - Current liabilities. Finance questions and answers. Net Working Capital Current.

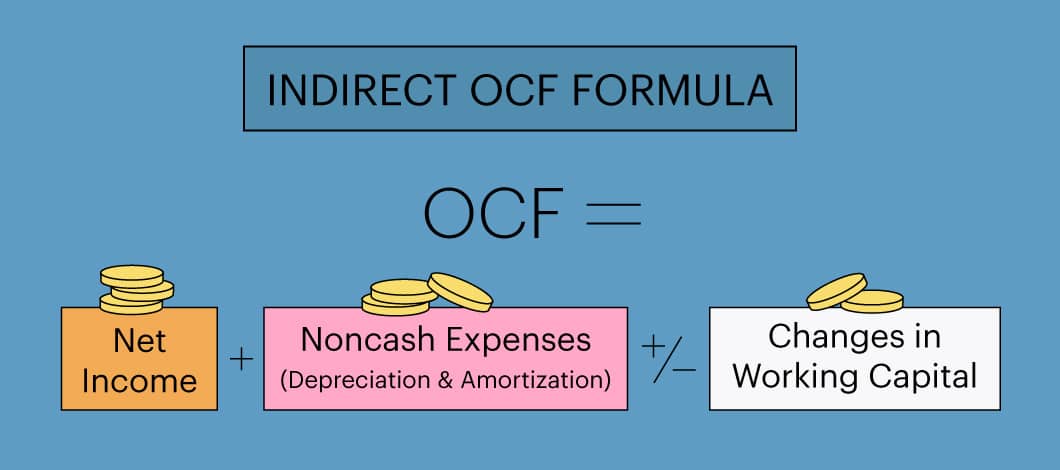

First they adjust the net income to account for the unpaid accounts receivable. On the Cash Flow Statement the Change in Working Capital is defined as Old Working Capital New Working Capital where Working Capital Current. In this example the change in working capital in.

A decrease in cash for example after purchasing a new property or equipment will decrease working capital. There are several different methods for calculating net working capital depending on what the analyst wants to include or exclude in the value. Then they use the formula.

Owner Earnings 8903 14577 5129 13312 2223 13084. Buying additional inventory or decrease its current liabilities. Since we have defined net working capital we can now explain the importance of understanding the changes in net working capital NWC.

An increase in working capital requires a company to use more capital to either increase its current assets eg. Free cash flow decreases. 500000 - 50000 450000.

Thus the formula for changes in non-cash working capital is. The changes in working capital items should be considered while computing the net cash inflow from the profit and loss account. Conversely working capital will also rise when cash increases.

In such a case instead of. Change in Working Capital Summary.

T10 1 Chapter Outline Chapter 10 Making Capital Investment Decisions Chapter Organization Project Cash Flows A First Look Incremental Cash Flows Pro Forma Ppt Download

Free Cash Flow To Firm Fcff Formulas Definition Example

Solved Compute The Net Working Capital Nwc Cash Flow 1 Chegg Com

How To Find Operating Cash Flow Learn To Calculate It With Examples

Changes In Net Working Capital All You Need To Know

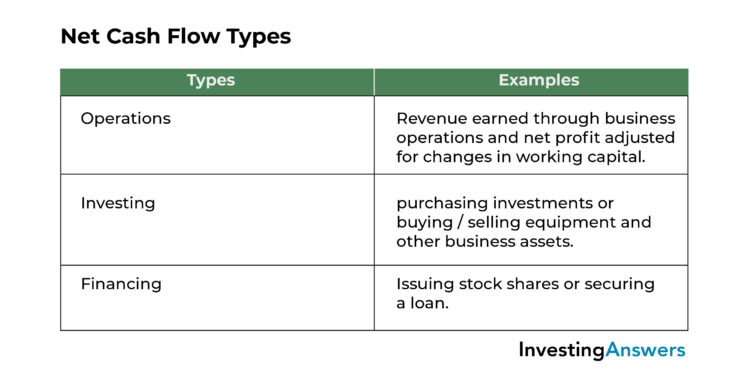

Net Cash Flow Formula Definition Investinganswers

Change In Net Working Capital Formula And Calculator Step By Step

Solved Calculate The Year 3 Cash Flow From Change In Net Working Capital Course Hero

Change In Working Capital Video Tutorial W Excel Download

Answered What Is The Net Change In Working Bartleby

How Are The 3 Financial Statements Linked Income Statement Balance Sheet And Cash Flow And Why It Matters Mrb Accounting 516 427 7313

Changes In Net Working Capital Step By Step Calculation

Change In Net Working Capital Formula Calculator Excel Template

How Do Changes In Working Capital Impact Cash Flow

Solved Finally We Must Adjust For Changes In Net Working Capital Remember That Increases In Current Assets Represent An Investment Of Cash Which Course Hero

Change In Net Working Capital From A Metric To The Valuation Of A Firm

Estimating Cash Flows On Capital Budgeting Projects Ppt Download